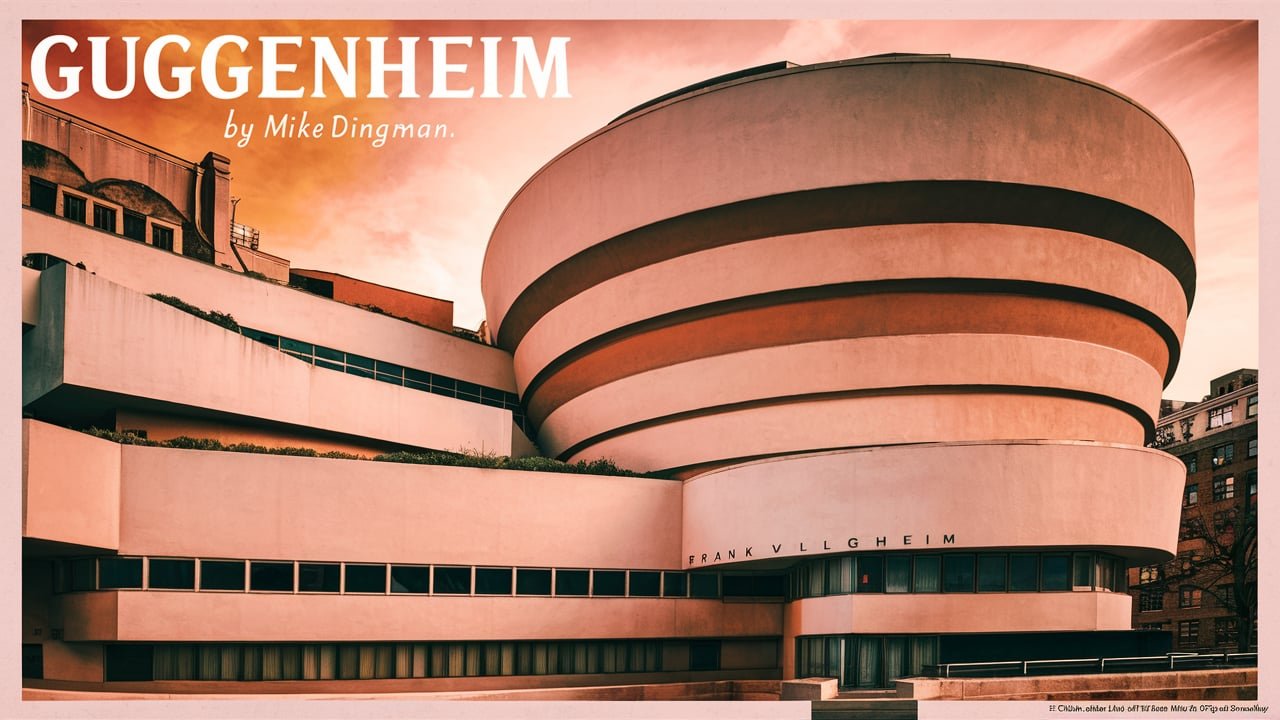

The Legacy of Mike Dingman: A Guggenheim’s Visionary Leader

In the annals of American business history, few names resonate with the same gravitas as Mike Dingman, a remarkable figure whose tenure at the Guggenheim empire marked a transformative era in corporate leadership. As a pioneering force in private equity and corporate restructuring, Dingman’s strategic acumen and innovative approaches not only reshaped the Guggenheim legacy but also set new standards for investment management and corporate governance in the late 20th century.

Early Life and Educational Foundation

Mike Dingman’s journey to becoming a corporate titan began in modest circumstances, shaped by a combination of intellectual curiosity and entrepreneurial spirit. Born into a middle-class family, he demonstrated exceptional business acumen from an early age. His undergraduate years at the University of Maryland laid the foundation for his future success, where he not only excelled academically but also developed a keen understanding of market dynamics and corporate structures. This period was crucial in forming his philosophy of value creation and strategic investment, which would later become his hallmark at Guggenheim.

The Guggenheim Era: Transformation and Innovation

During his tenure at Guggenheim, Dingman orchestrated some of the most significant corporate restructurings of his time. His approach was characterized by a unique blend of aggressive expansion and prudent risk management. Under his leadership, the firm underwent a remarkable transformation, shifting from traditional investment strategies to more dynamic and diversified portfolio management. He introduced revolutionary concepts in corporate governance, emphasizing transparency and accountability while maintaining the firm’s historic commitment to excellence. His management style, often described as both visionary and pragmatic, allowed Guggenheim to navigate through various economic cycles while consistently delivering value to stakeholders.

Strategic Vision and Corporate Philosophy

Dingman’s corporate philosophy was built on several key pillars that distinguished him from his contemporaries. He believed in the power of long-term value creation over short-term gains, a principle that guided many of his most successful investments. His strategic vision encompassed not just financial metrics but also organizational culture and sustainable growth. He was particularly known for his ability to identify undervalued assets and transform them into profitable ventures through strategic restructuring and operational improvements. This approach not only generated significant returns but also created lasting value in the companies under his stewardship.

Investment Innovation and Market Impact

One of Dingman’s most significant contributions was his innovative approach to investment management. He pioneered new methods of portfolio diversification and risk assessment that would later become industry standards. His investment strategies often focused on emerging markets and undervalued sectors, demonstrating an uncanny ability to spot opportunities others had overlooked. This period saw the implementation of sophisticated financial instruments and investment vehicles that helped Guggenheim maintain its competitive edge in an increasingly complex market environment.

Legacy and Lasting Influence

The impact of Mike Dingman’s leadership extends far beyond his immediate tenure at Guggenheim. His influence can be seen in modern corporate governance practices, investment strategies, and leadership approaches across the financial sector. He left behind a legacy of innovation, strategic thinking, and ethical leadership that continues to inspire new generations of business leaders. His emphasis on sustainable growth and long-term value creation remains particularly relevant in today’s rapidly evolving business landscape.

Frequently Asked Questions

Q: What were Mike Dingman’s most significant contributions to Guggenheim? A: Mike Dingman’s most significant contributions included revolutionizing the firm’s investment strategy, implementing innovative corporate governance practices, and successfully navigating through various economic cycles while maintaining consistent growth and profitability. His leadership transformed Guggenheim’s approach to portfolio management and established new standards for corporate restructuring.

Q: How did Dingman’s leadership style influence modern corporate governance? A: Dingman’s leadership style, characterized by transparency, accountability, and long-term value creation, has become a model for modern corporate governance. His emphasis on ethical leadership and sustainable growth continues to influence contemporary business practices and corporate strategy development.

Q: What principles guided Dingman’s investment philosophy? A: Dingman’s investment philosophy was guided by principles of long-term value creation, strategic diversification, and innovative risk management. He believed in identifying undervalued assets and transforming them through strategic restructuring while maintaining a focus on sustainable growth and operational excellence.

Conclusion

Mike Dingman’s tenure at Guggenheim represents a pivotal chapter in corporate America’s history. His visionary leadership, innovative investment strategies, and commitment to sustainable growth have left an indelible mark on the financial industry. The principles he established continue to resonate in today’s business world, serving as a blueprint for effective corporate leadership and strategic management. His legacy serves as a testament to the enduring impact of visionary leadership in shaping corporate success and industry standards. As modern business leaders face new challenges and opportunities, Dingman’s approach to value creation and strategic innovation remains remarkably relevant and instructive.